1. Introduction to the Expansion: Highlight the significance of CommBank's expansion of its low-interest green loan facility and its potential impact on the environment and community.

With the recent announcement of an expansion of its low-interest green loan program, Commonwealth Bank (CommBank) has taken a major step toward the finance industry's sustainability. The extension is to encourage a sustainable way of life and provide more support for environmental conservation-focused programs. CommBank aims to enable people and companies to invest in energy-efficient technologies and environmentally friendly practices with greater ease by expanding access to low-interest financing for green initiatives. This action represents the possible effects on the environment and the larger community, as well as CommBank's commitment to environmental responsibility. With this growth, CommBank is positioned to create a more sustainable future for everyone by encouraging more people to choose sustainable solutions that can help cut carbon emissions. 😃

In addition to making it simpler for people and companies to adopt eco-friendly habits, CommBank is subtly encouraging a move toward sustainable investing by growing its low-interest green credit program. Communities may embrace energy-efficient technologies, renewable energy sources, and other environmentally friendly practices more quickly as a result of this growth. Most notably, it can assist in removing financial obstacles that might have previously kept certain people from pursuing eco-friendly projects, providing opportunities for a wider range of people to get involved in creating a more sustainable future. This expansion may have knock-on consequences that include lower carbon footprints, more energy efficiency, and increased attempts to preserve the environment in a variety of industries.

Beyond its immediate consequences on borrowers, CommBank's enlarged low-interest green lending facility is significant because it speaks to our shared obligation as global citizens to fight climate change and lessen its negative effects. As it works to use its power for good, CommBank furthers its commitment to coordinating corporate operations with environmental sustainability goals through this program. Accepting this growth is a proactive way to support sustainability and shows support for the larger goal of addressing urgent environmental issues at a time when such measures are desperately required. Amid the urgent cries for sustainable action, CommBank's extended low-interest green credit facility stands out as a beacon of hope as more and more businesses choose environmentally responsible activities.

The extension of CommBank's low-interest green loan program has a lot of potential to spur the general adoption of environmentally friendly solutions and to actually move the needle toward sustainability goals on a local and global scale. This action can encourage people and businesses to adopt environmentally conscious habits that have a significant positive impact on the future of the environment by making it simpler to obtain financial options for green initiatives. With this improvement, CommBank leads the way globally in financial institutions' development of a commercially feasible route toward environmental sustainability.

2. Explaining Green Loans: Provide an overview of what green loans are, how they work, and their benefits for environmentally friendly projects.

One kind of funding especially meant to help ecologically friendly enterprises is the green loan. Sustainable initiatives including renewable energy, energy efficiency upgrades, water conservation, and green building development are frequently the emphasis of these projects. Green loans function in a manner akin to conventional loans, except they prioritize providing funding for environmentally sustainable projects.

Green loans offer two advantages. First of all, they give people and companies access to reasonably priced funding for projects that promote environmental sustainability. This makes it possible to carry out projects that would otherwise be financially difficult. Second, by encouraging the development of eco-friendly infrastructure and technology, green loans aid in the mitigation of greenhouse gas emissions and advance environmental conservation.

The ability of green loans to save money by lowering energy costs is a major advantage. For instance, installing energy-efficient renovations in buildings may result in decreased electricity costs over time, offsetting the original outlay. By lowering carbon footprints and the use of natural resources, these initiatives can improve the environment as a whole.

Green loans play a vital role in promoting sustainable practices and supporting the transition towards a greener future by offering accessible financing options for environmentally friendly projects.

3. Advantages for Borrowers: Discuss the specific advantages that borrowers can gain from utilizing CommBank's low-interest green loan facility, such as reduced costs and positive environmental impact.

For anyone looking to undertake eco-friendly home upgrades, CommBank's low-interest green financing program has many benefits. First off, because the low interest rates make it easier for borrowers to obtain cash at a lower cost than with traditional credit cards or personal loans, they can save money. Homeowners will find it easier to complete sustainable installations or renovations as a result of cheaper monthly payments and overall interest rates.

Through their projects, borrowers who use CommBank's green credit program make a good impact on the environment. The money can be used for projects like installing solar panels, making energy-efficient renovations, or improving homes to use less water. By funding these eco-friendly projects, borrowers support local conservation efforts and sustainable living standards while simultaneously lowering their carbon impact.

Aside from the financial and ecological advantages, borrowers who choose CommBank's low-interest green loan program might also benefit from more help and ease. Borrowers can easily acquire the necessary cash and receive help on selecting sustainable solutions that best suit their needs thanks to the bank's shortened application process and dedicated customer support for green initiatives.

Using CommBank's low-interest green loan program has several benefits, including financial savings, a favorable environmental impact, and the assurance that eco-friendly home modifications would receive committed assistance.

4. Detailing Eligible Projects: Outline the types of projects that are eligible for the green loan facility, including solar panel installation, energy-efficient home improvements, and other sustainability initiatives.

Homeowners wishing to invest in environmentally friendly projects may benefit from CommBank's extension of its low-interest green loan program. This facility's qualified projects are diverse and environmentally focused, with the main goals being lowering carbon footprints and increasing energy efficiency.

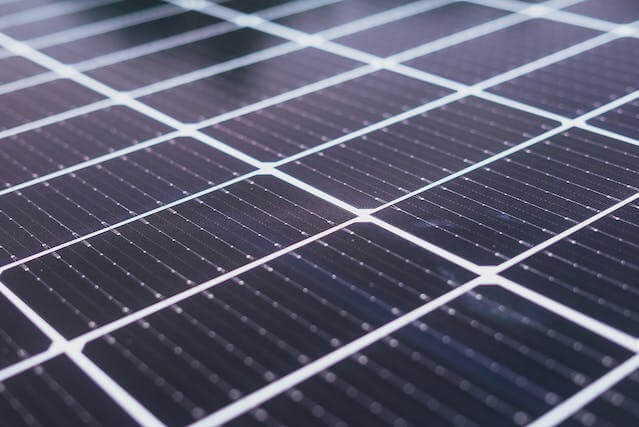

Installing solar panels is one of the main eligible projects for the green credit scheme. This gives homes a chance to capture clean energy sources while lowering their dependency on conventional power systems, which is in line with the growing trend towards renewable energy alternatives.

The facility also offers a range of energy-efficient house modifications, including smart home technology, HVAC system upgrades, and insulation upgrades. With these upgrades, homeowners may drastically reduce their overall energy use and have a beneficial impact on environmental conservation.

Apart from these well-known projects, additional sustainability endeavors such as water conservation systems, environmentally friendly landscaping, and infrastructure for charging electric vehicles are also included in the list of projects that qualify for funding. This illustrates CommBank's dedication to supporting a range of sustainability initiatives that significantly lessen the environmental effect in local communities.

By providing a wide range of qualified projects, CommBank hopes to make financing alternatives more accessible for people looking to upgrade their houses in an environmentally responsible manner. In addition to using these funds to upgrade their own homes, homeowners can also use them to support larger initiatives to promote sustainable living and fight climate change.

5. Application Process and Requirements: Walk readers through the application process for obtaining a low-interest green loan from CommBank, including eligibility criteria and necessary documentation.

CommBank offers low-interest green loans, and the application process is easy to use and convenient. Applicants can visit the CommBank website or chat with a representative at the branch closest to them to begin the application process. Being an Australian citizen or permanent resident, being older than 18, and presenting identity and evidence of income are usually the requirements for eligibility. The financing must be used for environmentally acceptable projects, such water-efficient irrigation systems, solar panels, or energy-efficient appliances.

Documentation proving income (paystubs or tax returns), identity (passport or driver's license), and information regarding the planned green project, together with cost quotes or estimates, are all required for the application. To make sure that borrowers can afford to return the loan, CommBank might also perform a credit evaluation.😶🌫️

After receiving all necessary paperwork, the bank will review the application and promptly notify the applicant of its decision. After approval, money is usually deposited straight into the applicant's designated account, allowing them to start their green project right away. Through inexpensive financing solutions, CommBank is facilitating the adoption of sustainable living among individuals through a straightforward application process and well-defined conditions.

6. Environmental Impact: Dive into the potential environmental impact of this expansion on reducing carbon emissions and promoting sustainable practices in the community.

The extension of CommBank's low-interest green lending program may have a big effect on the environment. The expansion can help lower carbon emissions by offering affordable financing choices for sustainable projects and energy-efficient renovations. This makes it possible for companies and homeowners to invest in energy-efficient heating and cooling systems, water-saving gadgets, renewable energy systems, and other green upgrades. Consequently, there's a chance to reduce overall energy use and dependency on fossil fuels.

Apart from curbing carbon emissions, the enlarged green financing facility can significantly contribute to the advancement of sustainable practices in the society. By facilitating the adoption of environmentally friendly practices by individuals and businesses, like solar panels or energy-efficient appliances, CommBank encourages more people to get involved in sustainability initiatives. This has the potential to trigger a more widespread cultural shift toward making decisions that are ecologically friendly, which will ultimately lead to a more sustainable and greener future.

These investments have a favorable impact on local economies and create jobs in the renewable energy sector, which goes beyond the advantages to the person. With the assistance of low-interest green loans, more residences and commercial buildings are implementing eco-friendly technology, which is driving up demand for experts in the installation, upkeep, and creation of sustainable industries. This promotes an environment where green technologies become more generally accepted and available in addition to stimulating economic growth.

Expanding its low-interest green loan program, CommBank hopes to empower communities to significantly reduce carbon emissions and promote the general adoption of sustainable practices, which will lead to real environmental change.

7. Testimonials or Case Studies: Share real-life success stories or case studies of individuals or businesses who have benefited from CommBank's low-interest green loans, highlighting their sustainable projects and outcomes.

When it comes to helping people and companies who want to invest in environmentally friendly projects, CommBank's low-interest green loans have changed everything. John, a small business owner, is one such success story. He installed solar panels on his commercial property using CommBank's green financing. As a result, John not only greatly decreased his energy expenses but also made a positive impact on his community's carbon emissions. In addition to providing financial benefits to his company, his investment in sustainability has established him as a pioneer in environmental responsibility.

Sarah, a homeowner, is another encouraging example. She used CommBank's low-interest green loan to install energy-efficient heating and cooling systems and upgrade her insulation in her home. Sarah was able to make her house more environmentally friendly with the help of CommBank, which resulted in lower energy costs and utility bills. Her experience serves as an example of how easily available green financing can enable people to save money over time while also enabling them to make significant contributions to environmental conservation.

These actual success stories show how CommBank's low-interest green loans have enabled people and companies to start environmentally friendly and financially advantageous sustainable projects. A wide range of sustainable projects across varied communities are inspired and supported by CommBank because it offers funding solutions that are both accessible and cheap.

8. Comparison with Traditional Loans: Compare the benefits and differences between traditional loans and CommBank's low-interest green loans to emphasize their unique advantages in terms of cost savings and environmental benefits.

There are a number of significant advantages and distinctions between CommBank's low-interest green loans and standard loans. Because traditional loans involve greater risks for the lender, interest rates are often higher. If you're wanting to invest in sustainable projects, CommBank's low-interest green loans are a great choice because they provide lower interest rates that are expressly intended to support eco-friendly activities.

Conventional loans frequently don't offer special incentives or advantages designed for environmentally friendly projects. Conversely, CommBank's green loans offer borrowers not just favorable interest rates but also extra advantages including resource access and knowledge of eco-friendly procedures. With this all-encompassing strategy, borrowers are guaranteed cost savings as well as invaluable assistance in successfully executing their green projects.

Compared to CommBank's green loans, traditional loans could have more rigorous standards and drawn-out approval processes. CommBank's green loans facilitate faster access to funding for environmentally friendly projects due to their shortened application and approval process. This allows borrowers to start their sustainability projects right away and avoid needless delays.

When it comes to financial savings and environmental advantages, CommBank's low-interest green loans are particularly noteworthy since they provide borrowers with a practical means of lowering their carbon footprint while saving money on financing. Through the use of these green loans, borrowers can simultaneously save money in the long run by reducing interest costs and promoting environmentally beneficial projects. 😥

The low interest rates designed for environmentally friendly endeavors, extra support for sustainable practices, simplified application procedures, and the combined cost savings and environmental benefits that CommBank's low-interest green loans offer make them stand out from more conventional options. Considering these aspects, it is evident that green loans offer a compelling substitute for people and companies seeking to start ecologically conscious projects with the least amount of financial strain.

9. Partnership with Environmental Organizations: Highlight any partnerships or collaborations that CommBank has formed with environmental organizations to promote and support sustainable initiatives through these expanded loan facilities.

In addition to offering financial support for environmentally friendly projects, CommBank is expanding its low-interest green loan program in order to collaborate with environmental groups and increase beneficial impact. The bank has taken the initiative to collaborate with important environmental organizations in order to support and encourage sustainable initiatives and practices. By means of these collaborations, CommBank hopes to increase the scope and efficacy of its green lending offerings by utilizing the knowledge and connections of these institutions. The bank may have access to a multitude of sustainability information and expertise by working with environmental organizations. This will help to guarantee that its lending programs follow industry best practices and make a significant contribution to environmental conservation efforts. In this approach, CommBank shows that it is dedicated to forming solid partnerships that increase the impact of sustainable activities in addition to offering financial resources.

10. Future Expansion Plans: Discuss any future plans or potential areas where CommBank aims to expand its low-interest green loan facility, signaling its ongoing dedication to environmental sustainability.

CommBank's future development plans for its low-interest green credit facility demonstrate the bank's commitment to environmental sustainability. In order to provide inexpensive financing for sustainable initiatives, the bank wants to make these loans available to more clients throughout Australia. This would allow people and businesses in various regions to pursue their sustainable ideas.

CommBank is to investigate joint ventures with non-profits, local governments, and other relevant parties in order to broaden the scope of its green lending program. The bank hopes to promote a greater spectrum of projects that lead to a better future and find new prospects for environmental efforts by working with these organizations.

CommBank is thinking about extending the scope of its low-interest green lending program to include more sustainable projects. This could involve providing funds for the installation of renewable energy sources, energy-efficient renovations for business buildings, environmentally friendly transportation options, and other cutting-edge initiatives that support the bank's environmental goals.

By consistently growing and changing its low-interest green loan program, CommBank demonstrates its commitment to promoting environmental impact and enabling people and companies to adopt sustainable practices.

11. Community Outreach Initiatives: Explore any community outreach programs or educational efforts initiated by CommBank in conjunction with the expanded green loan facility to raise awareness about sustainable lending options.

CommBank has launched a number of community outreach initiatives and educational campaigns to increase awareness about sustainable lending options in tandem with the enlarged green loan facility. In order to highlight the advantages of low-interest green loans and promote sustainable practices, these programs seek to interact with local businesses, organizations, and communities.

The educational workshops that CommBank offers in association with environmental organizations and business specialists are one example of such a program. The advantages of green financing, energy-efficient improvements, and other sustainable alternatives are covered in-depth in these sessions. CommBank wants to enable people and companies to make ecologically responsible decisions by educating them about sustainable finance possibilities.

In order to start instructional efforts aimed at younger generations, CommBank has also teamed up with neighborhood community centers and schools. These programs are aimed at teaching kids and teenagers the value of eco-friendly behavior and the part sustainable finance plays in creating a brighter future. These initiatives aim to inculcate in the young of the community a feeling of environmental responsibility through participatory activities, presentations, and outreach events.

CommBank demonstrates its dedication to advancing environmentally conscious financial solutions and encouraging environmental stewardship among individuals, corporations, and communities at large by actively participating in community outreach programs.

12. FAQs about Green Loans: Address common questions that readers might have about applying for a low-interest green loan with CommBank, providing clarity on terms, conditions, and other essential details.

1. What are green loans?

Green loans are especially made to assist people and companies in funding eco-friendly initiatives like installing solar panels, buying energy-efficient equipment, or even making improvements to their homes that lessen their carbon footprint. Generally, these loans have flexible terms and reduced interest rates to entice borrowers to fund sustainable projects.

2. What is the Low-Interest Green Loan facility from CommBank?

The Low-Interest Green Loan facility offered by CommBank is a financing option designed to assist clients who wish to renovate their homes or small enterprises in an environmentally responsible manner. The bank provides a cost-effective solution for consumers to finance their green initiatives by offering this loan at a lower interest rate than its regular personal loan rates.

3. How can I qualify for a low-interest green loan with CommBank?

Applicants must fulfill particular requirements, including being an active CommBank customer with a clean credit history and having a clear strategy for allocating the funds to an approved environmentally friendly project, in order to be considered for CommBank's Low-Interest Green Loan. Documentation pertaining to the planned project, proof of income, and other customary loan conditions could be requested by the bank.

4. What types of green projects can be financed through CommBank's low-interest green loan?

The CommBank low-interest green loan can be used to fund a range of eco-friendly initiatives, such as installing solar panels, buying electric vehicles, upgrading insulation, installing water-saving fixtures, and installing energy-efficient heating and cooling systems. It's critical for applicants to confirm that the project they intend to pursue satisfies the bank's qualifying requirements.

5. What are the terms and conditions of CommBank's Low-Interest Green Loan?📍

Details on the loan amount, interest rate, repayment schedule, fees (if applicable), and any special requirements pertaining to the authorized green project are all included in the terms and conditions of CommBank's Low-Interest Green Loan. Before submitting an application for a loan, applicants should carefully read these terms and, if necessary, ask the bank for clarification.

6. Can I use CommBank's low-interest green loan for commercial purposes?

Yes, small business owners wishing to make investments in environmentally friendly renovations for their commercial spaces can take advantage of CommBank's Low-Interest Green Loan. This could entail updating insulation for increased energy efficiency, installing energy-efficient appliances or lights, or taking part in other environmentally friendly sustainable projects.

7. What documents do I need to provide when applying for a low-interest green loan with CommBank?

As required by the bank's regular lending procedure, you might also need to submit identification documents and proof of income in addition to quotes or estimates from suppliers or installers pertaining to the eco-friendly project you have selected when applying for a low-interest green loan with CommBank.

8. What are some tips for maximizing the benefits of a low-interest green loan?

Thoroughly researching and organizing your eco-friendly project in advance can help you make the most of a low-interest green loan. This includes getting quotes from several suppliers and installers, realizing potential long-term energy savings, and making sure your upgrades are in line with your sustainability objectives.