1. Introduction to the NAB's decision to end coal mine financing and shift towards renewables.

A major statement by National Australia Bank (NAB) represents a turning point in the global switch to renewable energy. By agreeing to stop funding new thermal coal mining operations and progressively phase out assistance for current thermal coal clients by 2035, the bank has shown courage. This action is in line with NAB's sustainability commitments and shows a distinct shift in focus from fossil fuels to renewable energy sources. NAB has made clear that it intends to create a portfolio focused solely on renewable energy, indicating that it is strategically focused on promoting and advancing clean energy programs. This choice demonstrates the financial industry's increasing commitment to adopting sustainable practices and giving environmental stewardship first priority.

The choice to stop funding coal mines demonstrates NAB's proactive stance in tackling climate change issues and cutting carbon emissions. NAB is demonstrating its recognition of the need to reduce its environmental impact and adopt greener energy alternatives by renouncing its support for thermal coal extraction. This action not only establishes NAB as a major player in the advancement of the renewable energy industry in Australia and abroad, but it also shows a conscientious attitude toward environmental stewardship.

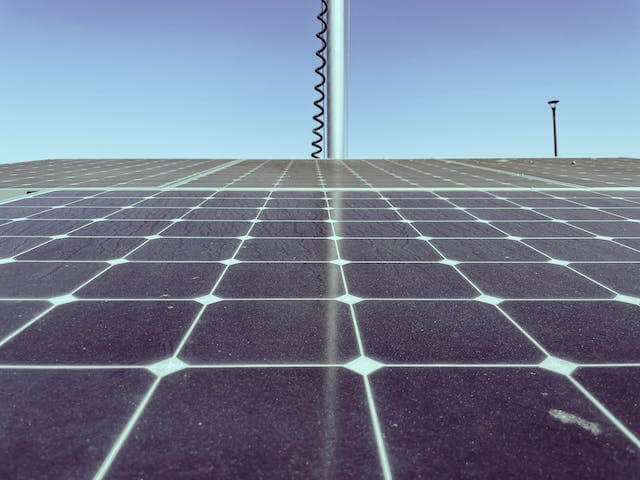

With NAB's dedication to building a renewables portfolio, more capital will soon be flowing into clean energy technology and infrastructure. With this committed focus, the bank hopes to contribute significantly to quickening the shift to sustainable energy sources like hydro, solar, wind, and other renewables. NAB hopes to promote innovation, propel technological development, and ease the general adoption of clean energy solutions by allocating funds expressly for renewables.

Taking into account everything mentioned above, we can say that NAB is leading the way for financial institutions globally with its decision to stop financing coal mines and instead establish a specialist renewables portfolio. This tactical change highlights NAB's commitment to sustainable operations and solidifies its standing as a leading supporter of renewable energy projects. Observing this turning point in the history of banking makes it clear that NAB is accepting its responsibility as a change agent to promote a more sustainable and environmentally friendly future for everybody.

2. The impact of NAB's move on the coal mining industry and the renewable energy sector.

The coal mining industry receives a strong message from NAB's decision to stop financing coal mines, indicating a dramatic change in the financial environment. This action will probably have a noticeable effect on the coal mining sector, possibly increasing capital costs and limiting funding options. NAB's decision to concentrate on renewable energy will open up opportunities for more investment and industry expansion in this area.

The move by NAB is indicative of a growing movement among financial institutions to support sustainable projects and remove themselves from carbon-intensive sectors of the economy. This action might cause other banks and financial organizations to reconsider how they support coal mining, which could result in even more financing cuts for these projects. Therefore, as access to capital becomes more restricted, the decision made by NAB may have an impact on the whole coal mining business.

In addition, NAB's pledge to develop a new renewables portfolio highlights the industry's potential for rapid expansion. NAB's transition to renewable energy sources, as one of the biggest banks in Australia, offers a substantial chance for investment and growth in clean energy initiatives. This action might spur investment in renewable energy, encouraging innovation and quickening the shift to a low-carbon economy.

The industry for coal mining as well as the renewable energy sector expect to be greatly impacted by NAB's strategic shift away from funding coal mines. It opens up new avenues for expansion and advancement in the renewable energy sector and heralds a wider trend towards sustainable finance.

3. Exploring NAB's strategy in creating a new renewables portfolio and its potential for growth.

The major step made by NAB to stop financing coal mines and concentrate on developing a new renewable energy portfolio is in line with the expanding worldwide trend towards sustainable energy. The bank is positioned as a leader in the shift to renewable energy thanks to its approach in building this portfolio, which shows a dedication to environmental responsibility.

NAB may play a major role in the expansion and advancement of sustainable energy initiatives by making proactive investments in renewable energy. In addition to enabling NAB to promote eco-friendly initiatives, this strategic move puts the bank in a position to profit from the growing renewable energy sector. With the increasing emphasis on sustainable energy solutions by governments and industry globally, NAB's renewables portfolio offers significant prospects for expansion and novelty.📗

NAB's decision to establish a renewables portfolio demonstrates its awareness of the growing need for alternate energy sources. The bank can address the changing demands of its stakeholders and clients while simultaneously promoting the use of renewable technology by strategically positioning itself in this sector and utilizing its resources and experience. This progressive stance not only upholds NAB's long-term sustainability objectives but also demonstrates its continued relevance in a dynamic energy environment.

4. Highlighting the environmental benefits of transitioning from coal to renewable energy.

There are numerous environmental advantages of switching from coal to renewable energy that are indisputable. The biggest benefit is the considerable decrease in carbon emissions, which are the main cause of climate change worldwide. Through the utilization of renewable energy sources like solar, wind, and hydroelectric power, we can significantly reduce our dependency on fossil fuels and the detrimental effects they produce.

Water and air pollution can also be reduced with the use of renewable energy. Renewable energy sources emit little to no particulate matter, sulfur dioxide, and nitrogen oxides into the atmosphere, in contrast to coal-fired power stations. It is well established that these contaminants are harmful to both the environment and human health. By moving away from coal, less hazardous substances and heavy metals are released into waterways during the mining and burning processes.

The environmental impact of renewable energy technology is significantly lower than that of coal mining activities. Compared to coal mines or power plants, which need large amounts of land to store waste, solar panels and wind turbines require significantly less space for installation. This change prevents large mining activities from destroying the environment while also protecting natural ecosystems.

Making the switch to renewable energy helps protect biodiversity. It has been demonstrated that the development of renewable energy infrastructure has a lower environmental impact on wildlife habitats than the mining and processing of coal. We can contribute to the preservation of a variety of habitats and the creatures that call them home by adopting cleaner energy sources.

To conclude my previous writing, switching from coal to renewable energy has several environmental advantages that support sustainability and protect the future of our world. We can create a cleaner and healthier environment for future generations by limiting the impact of land use, cutting pollution, decreasing carbon emissions, and promoting biodiversity conservation.

5. Discussing the economic implications of NAB's decision for both the bank and the broader market.

There are major economic ramifications for the bank and the market at large from NAB's decision to stop financing coal mines and concentrate on developing a new renewables portfolio. This action is a strategic change in NAB's investment strategy that will better connect its financial operations with the worldwide movement to sustainable energy. This could improve NAB's long-term financial stability by lowering its exposure to hazards associated with fossil fuels and creating opportunities in the quickly expanding renewable energy market.

From an economic perspective, NAB's choice is indicative of a growing understanding of the monetary risks connected to conventional fossil fuel investments. NAB is adapting to changing market trends and investor preferences by removing its backing of coal mines and embracing renewable energy sources. By adopting this change, the bank may establish itself as a pioneer in sustainable finance, drawing in eco-aware investors and maybe improving its overall financial results.

The market may be affected more broadly by NAB's move to renewable energy if it spurs more changes in the banking sector. Other financial institutions might review their investment strategy in response to NAB's strategic turn, which might have a cascading effect on the industry. This choice could benefit the economy as a whole by encouraging innovation and the creation of jobs in the renewable energy industry.

There are significant financial ramifications for NAB and the larger market from the bank's shift away from financing coal mines and toward a new portfolio of renewable energy sources. It also emphasizes how financial institutions may take the lead in making investments that are motivated by sustainability and signifies a proactive reaction to changing market circumstances. NAB wants to be at the forefront of sustainable finance activities by embracing renewables and reducing the risks associated with traditional fossil fuel investments. This change could lead to other similar shifts in the banking sector and be beneficial for the renewable energy industry as well as the economy as a whole.

6. Addressing challenges and opportunities associated with NAB's transition to a renewables-centered portfolio.

NAB has possibilities and problems as it transitions from financing coal mines to a portfolio focused on renewable energy. Making sure the changeover goes well without upsetting current relationships and operations is one of the biggest challenges. To lessen any possible negative effects, careful planning and coordination with stakeholders might be necessary.

On the other side, NAB has a lot of opportunity as it moves toward a portfolio focused on renewable energy. It enables the bank to promote a low-carbon economy and be at the forefront of sustainable finance. NAB can help fight climate change and take advantage of the expanding market for clean energy investments by funding renewable energy projects.

Adopting renewable energy creates new opportunities for collaboration and innovation. NAB can look into joint venture possibilities with tech businesses and renewable energy companies, which could result in new business models and revenue streams. Adopting cutting-edge technology for renewable energy will help NAB establish itself as a creative leader in the banking sector.

Through the shift, NAB has the chance to enhance its reputation as a financially prudent company and build its brand. NAB can draw in socially conscious investors, clients, and partners that are looking for more ethical and ecologically friendly corporate operations by coordinating its portfolio with sustainability goals.

Even if this shift to a portfolio focused on renewables has its share of difficulties, NAB has a great chance to establish itself as a pioneer in sustainable financing and influence positive change within the sector by taking use of these opportunities.

7. Examining potential partnerships and investments as part of NAB's renewable energy initiative.

The move by NAB to switch from financing coal mines to a portfolio of renewable energy represents a dramatic change in the banking sector's attitude toward sustainable investments. NAB is actively looking into possible collaborations and investments in the renewable energy industry as part of this program.

NAB looks for ways to work with well-established renewable energy companies in order to harness their resources and experience to advance the development of clean energy projects. This calculated move capitalizes on the enormous potential for the growth of renewable energy sources while also being consistent with the bank's mission to support sustainable projects.

NAB's emphasis on cultivating partnerships in the renewable energy industry highlights its commitment to promoting positive effect through investment. NAB is working to accelerate the development of renewable technologies and support the shift to a more sustainable and environmentally friendly future by giving priority to partnerships with forward-thinking industry participants.

NAB is considering direct investment options in renewable energy projects as addition to partnering alternatives. The bank hopes to accomplish two things with focused financial support for these initiatives: it will help build new sustainable infrastructure and provide investors with good returns that are in line with their sustainability objectives.

As part of its renewable energy program, NAB is actively exploring prospective partnerships and investments. This approach is consistent with a broader trend in the banking industry, which highlights a critical move toward impactful and environmentally sensitive investing strategies. This reform not only helps with international efforts to tackle climate change, but it also represents a change in the way financial institutions see their part in creating a more sustainable future.

8. The global implications of financial institutions like NAB shifting away from coal towards sustainable energy sources.

The decision of financial organizations like NAB to switch from coal to renewable energy sources has important worldwide ramifications. By taking this action, the financial sector is strongly advised to see renewable energy investments as both financially and morally responsible. Being one of the biggest banks in Australia, NAB's choice serves as a model for other financial organizations across the globe, urging them to think about the long-term effects their investments would have on the environment and the economy.

The move away from financing coal also fits well with global initiatives to slow down climate change. NAB advances worldwide efforts to shift to a low-carbon economy and lowers greenhouse gas emissions by diverting money from coal mines to renewable energy sources. This action might lead to a global shift in financial institutions' investment policies and a prioritization of eco-friendly initiatives, which would speed up the world's transition to cleaner energy sources.

Other nations and areas that presently rely on coal for energy generation can be motivated by NAB's dedication to developing a new portfolio of renewable energy sources. These regions are more inclined to think about making comparable changes in their own energy portfolios when they observe large financial giants like NAB embracing renewable energy. As more nations are encouraged to engage in and build renewable energy infrastructure, this might result in significant changes to the global energy landscape and help ensure a more sustainable future for all.

9. Responses from stakeholders, including environmental organizations, industry experts, and affected communities regarding NAB's decision.

Environmental groups applauded NAB's move to switch to renewable energy and stop financing coal mines. The action has been hailed by Greenpeace Australia Pacific as a positive step for the environment. Experts in the field have also responded favorably, emphasizing the renewables sector's potential for expansion and innovation. Affected communities close to coal mining sites have also endorsed the decision; many have expressed relief at the thought of lessening the impact on the environment and improving the quality of the air.📎

Nonetheless, a few interested parties have expressed worries about how this choice may affect regional economies that significantly depend on coal mining. Various industry associations and community representatives have emphasized the necessity of a just transition strategy to assist the workers and areas impacted by this move away from coal. They call on financial institutions to take into account the socio-economic effects and offer sufficient support for individuals who are directly affected by these changes, even as they acknowledge the benefits to the environment. Following the NAB statement, stakeholders continue to debate how to strike a balance between environmental responsibility and taking into account the needs of impacted communities.

10. Analyzing the long-term effects of this move on Australia's energy landscape and climate policies.

The decision by NAB to stop financing coal mines and launch a new renewables portfolio signifies a dramatic change in Australia's energy and climate policies. This action is probably going to have a lasting impact on how the nation approaches environmental sustainability and energy generation.

The decision reflects growing pressure on financial institutions to remove their fossil fuel holdings and is in line with global trends towards renewable energy. Being one of the biggest banks in Australia, NAB's decision to leave the coal mining business sends a clear message to investors, legislators, and other industry players about the future of the energy sector. It might force other financial organizations to reconsider their approaches to investing and hasten the shift to greener options.

NAB's action may have an impact on government decision-making about climate measures. This change may persuade regulators to give policies that promote the growth of renewable energy sources and emission reductions top priority by indicating a reduced willingness to tolerate carbon-intensive projects. The bank's choice might indirectly impact more extensive government measures by creating a precedent for aggressive climate action in the financial sector.

The strategic shift by NAB away from funding coal mines has the potential to change Australia's energy environment and its long-term climate policy strategy. This change may hasten the shift to a more resilient and ecologically conscious energy sector as more financial institutions take notice and public opinion stays favorable to sustainable practices.

11. Exploring public sentiment and reactions to NAB's commitment to phasing out coal financing in favor of renewables.

Public opinions and reactions were mixed when word spread that the National Australia Bank (NAB) would no longer be funding new thermal coal mining projects by 2030 and would instead be focusing on expanding its portfolio of renewable energy sources. This action by NAB is in line with international initiatives to shift toward renewable energy sources and indicates a rising knowledge of and concern for the environmental effects of fossil fuels.

The bank has been praised by those who support NAB's stance for being proactive in addressing climate change and supporting sustainable energy choices. Numerous supporters of renewable energy, governments, and environmental groups have hailed NAB's proposal as a critical turning point in the world's transition away from economies dependent on coal.

On the other hand, the coal industry has received conflicting responses from people and groups who are worried about the possible effects on employment, regional economies, and current infrastructure investments tied to coal. Opponents contend that eliminating coal finance could cause economic instability in areas where coal production is essential, hence creating difficulties for communities and laborers who depend on this sector.

Financial analysts and stockholders have differing opinions about how NAB's strategic change will play out in the long run. Given the changing energy landscape and the increasing need for renewables, some see this as a financially reasonable decision; others, however, doubt the effectiveness of such transitions in attaining both environmental goals and ongoing profitability.

With its commitment, NAB is demonstrating the intricate interplay between environmental responsibility, economic considerations, job security, technological innovation, and policy frameworks that define our collective journey towards a more sustainable future. This is a significant moment in the ongoing dialogue surrounding energy transition and climate action.